Buy Muslimska kvinnor Abaya Lång Full Sleeve Islamiska Klänningar Kläder Modest Outfits Golvlängd Tassel Klänning Arabiska stil klänning Online at Lowest Price in Ubuy Sweden. B09LCKTPVX

💰Köp billigt online INCERUN Plus Size Jubba Thobe Men Islamic Arabic Kaftan Solid Short Sleeve Loose Casual Robes Abaya Middle East Muslim Clothing till ett lågt pris på Joom butik

💰Köp billigt online INCERUN Plus Size Jubba Thobe Men Islamic Arabic Kaftan Solid Short Sleeve Loose Casual Robes Abaya Middle East Muslim Clothing till ett lågt pris på Joom butik

Xingsiyue Saudi Arabiska Män Jubba Mantel Muslimsk Islamisk Thobe Långärmad Kaftan Abaya Mellanöstern Dubai Lösa Etniska Kläder : Amazon.se: Mode

💰Köp billigt online INCERUN Men Saudi Style Thobe Thoub Abaya Robe Dishdasha Islamic Arab Kaftan Muslim Clothing for Men till ett lågt pris på Joom butik

Köpa online Arabiska Vintage Lace Bröllop Klänningar Djup V-hals Illusion Lång ärm Pärlstav Brudklänningar Med Slöja Kläder De Mariee / Bröllop & Events | Necessarer.se

ZANZEA Muslimsk mode bomull klänning Mellanöstern Ramadan Arabiska Islamiska Kläder Klänning Kvinnor Abaya Dubai Kaftan Långa Klänningar Kläder köp billigt — fri frakt, ärliga recensioner med bilder — Joom

Lång fräsch klänning Klänning Kvinnors Klänningar 2021 Kaftan Abaya Lång Muslimska Kväll Klänningar Hijab Abayas Turkiska Hijab Fest Kvinnor Casual Kläder På rea! ~ Traditionella Och Kulturella Slitage / Aeroled.se

Porträtt Av Arabiska Män I Nationella Kläder. Dishdasha Kandora Thobe Islam. Kopieringsutrymme Arkivfoto - Bild av säkert, östligt: 217631734

Köp Afrahul Kvinnor Passar Muslimska kvinnors mellanöstern passa turkiet arabiska lös avslappnade kostym muslimska sätter islamiska kläder muslimska kvinnor / Butiken - www.kampsportboras.se

GladThink Thobe med långa ärmar, arabiska muslimska kläder, vadlånga byxor ingår, Svart, S : Amazon.se: Mode

Arab-kvinnor Med Traditionella Kläder Eller Abaya Fotografering för Bildbyråer - Bild av modeller, tavla: 212996657

💰Köp billigt online |New Season| Leopard Women's Long Muslim Dress Modest Fashion Islamic Clothing Women Kaftan Morocco Arabic Turban Muslim Tops till ett lågt pris på Joom butik

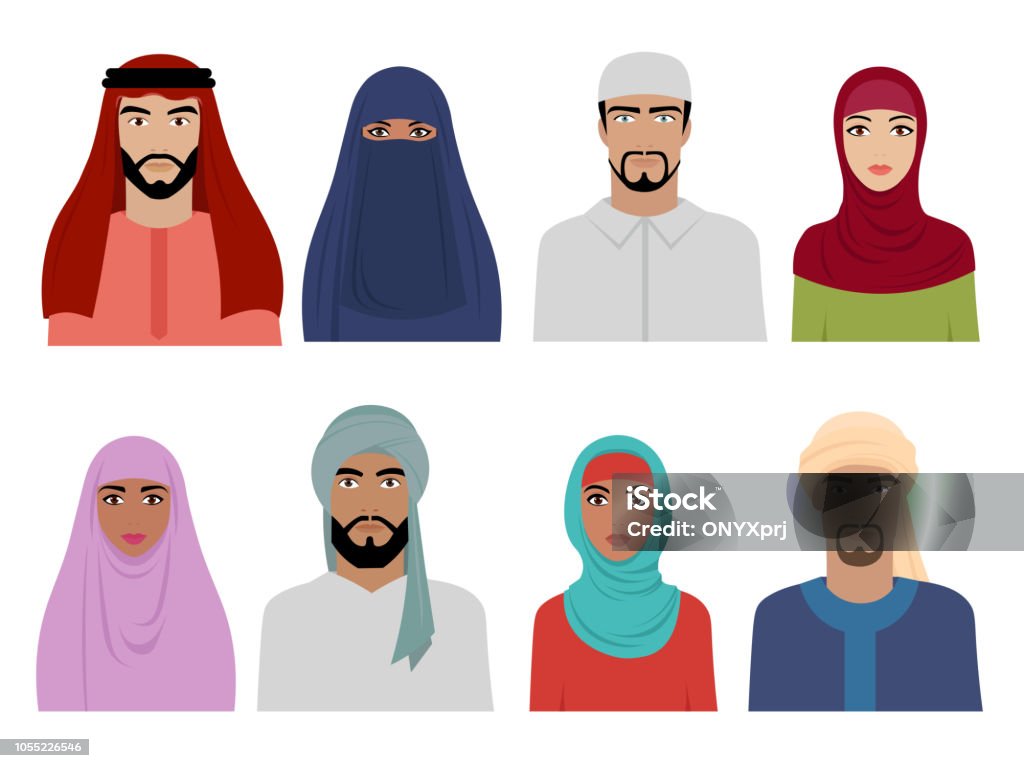

Muslimska Arabiska Människor I Långa Traditionella Kläder Vektor Illustration-vektorgrafik och fler bilder på Affärsman - iStock

Arabian keffiyeh vectors Stockvektorer, royaltyfria Arabian keffiyeh vectors illustrationer - Page 3 | Depositphotos

💰Köp billigt online Muslim Scarves Ramadan Eid Open Abaya Dubai Turkey Hijab Dress Abayas for Women Mubarak Arabic Islam Clothing Caftan Kaftan Robe Muslim Dresses till ett lågt pris på Joom butik

Porträtt Av Arabiska Män I Nationella Kläder. Dishdasha Kandora Thobe Islam. Kopieringsutrymme Arkivfoto - Bild av säkert, östligt: 217631734